Report On Copper Clad Laminate Industry 2021

2021-05-14

Copper Clad Laminate (CCL) is the raw material used to process PCB, so the PCB industry is the main influencing factor of CCL.

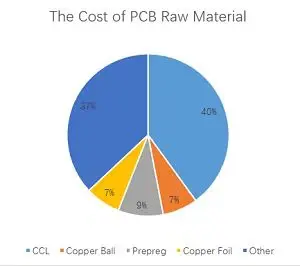

Copper Clad Laminate (CCL) is the raw material used to process PCB, so the PCB industry is the main influencing factor of CCL. Copper clad laminates account for 40% of the cost of PCB raw materials. In 2019, the global sales of copper clad laminate were 12.4 billion U.S. dollars.

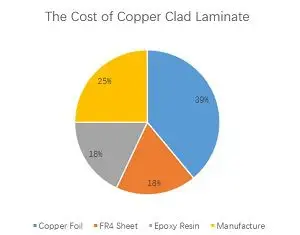

The main raw materials of copper clad laminates are copper foil, FR4 fiberglass sheet, and epoxy resin. The cost of raw materials accounts for 75%, of which copper foil accounts for 39%. Therefore, with the increasing price of raw materials such as copper prices, in March 2021, copper clad laminate companies have successively issued notices of 15-20% price increased.

|

|

According to the performance of the material, copper clad laminates are divided into conventional FR4, special resin-based special (mainly high-frequency and high-speed plates), halogen-free FR4 sheet, high Tg FR4 and others. Specially, high-frequency and high-speed boards are growing rapidly due to the performance advantages in 5G and servers, and the output value of other copper clad laminates is relatively stable.

From the perspective of future development potential, communications, servers/data storage, and automobiles are the best subdivision tracks for PCB and copper clad laminates in the future. so, we focus on analyzing the demand for communication, server and automotive-related PCBs and copper clad laminates.

1.5G

Since 5G has increased standard of high frequency, the cost of PCB of 5G single base station has increased from about 3,000 yuan to about 10,000 yuan, which drives the demand for copper clad laminates, especially high-frequency high-speed boards. Based on the forecasted number of base stations and industrial chain survey data, we estimate that the overall 5G copper clad laminate market will reach 39.9 billion yuan. Regular copper clad laminates accounted for 6.4 billion, accounting for 16%. High-speed CCL 20.4 billion, accounting for 51%. 13.2 billion high-frequency copper clad laminates, accounting for 33%. According to annual calculations, 5G copper clad laminates will reach to 5.7 billion in 2021 and 6.8 billion in 2022, an increase of 358% from 2019.

2. Servers/Data Storage

In 2019, the global server sales volume was 11.75 million units, and the sales amount reached 87.2 billion U.S. dollars. In 2019, the size of the Chinese server market was US$18.5 billion (approximately 127.6 billion), and the compound growth rate from 2015 to 2019 was 23%, which was 11% higher than the growth rate of the global market during the same period. Due to the application of high value-added materials such as high-frequency and high-speed boards, the value of copper clad laminates has gradually increased. The global server CCL demand has increased from 5.3 billion in 2019 to 15.7 billion in 2023, with a compound annual growth rate of 31%.

3. Automobiles

The trend of electrification and intelligence of automobile promotes the demand of PCBs in automotive, thereby driving the demand for copper clad laminates. The value of PCBs for automobiles has increased from US$56 in 2015 to US$63.2 in 2018. Moreover, the PCB usage of new energy vehicles is 800-1000 yuan higher than that of traditional vehicles. Combining the consumption of PCBs for traditional automobiles and the high growth of new energy vehicles, it is estimated that the PCB market for automobiles will reach to 67.4 billion in 2022. It is estimated that the value of CCL in the PCB is about 20%, and it is estimated that the scale of CCL for vehicles in 2022 will be about 13.5 billion.